Breaking the Myth: Why You Don’t Need Thousands to Start Trading

When most people think about trading, the image that often comes to mind is one of high-powered professionals in expensive suits, dealing with massive sums of money. There’s a persistent myth that you need thousands of dollars to even think about starting your trading journey. But the reality? The barriers to entry in trading have drastically decreased over the years, thanks to advancements in technology and innovative platforms.

In fact, starting small is not only possible—it’s practical. Let’s break down why you don’t need a massive bankroll to enter the world of trading and how platforms like Deriv make it possible for anyone to get started with as little as $5.

1. The Rise of Low-Cost Trading Platforms

A couple of decades ago, trading required significant capital because of high broker fees, commissions, and minimum deposit requirements. But with the growth of online trading platforms, those barriers have fallen away. These platforms allow you to trade without needing large sums upfront and often offer zero-commission trades or very low fees.

For instance, platforms like Deriv have made trading accessible to everyone by offering low-cost trades and requiring minimal deposits to get started. With as little as $5, you can begin exploring the world of forex, stocks, and even cryptocurrencies. This makes trading a viable side hustle or investment opportunity for people at every income level.

2. The Power of Micro-Trading

Another factor that has made trading accessible is the concept of micro-trading. Micro-trading allows you to make trades with very small amounts of capital. Many platforms now offer fractional trading, which means you don’t have to buy a full share of stock or an entire cryptocurrency coin; you can buy a fraction of it, making it easier to diversify your portfolio without needing thousands of dollars.

This is where platforms like Deriv shine. They offer the ability to trade small amounts, helping beginners gain experience without risking large sums of money. By trading in small increments, you can steadily build your portfolio over time and gradually increase your investments as you gain confidence.

3. Risk Management on a Budget

One of the biggest concerns for new traders is the potential risk involved in trading. However, with today’s technology, even beginners can easily manage risks while trading with small amounts of capital. Many platforms offer built-in risk management tools, like stop-loss orders, that automatically close a trade once a certain threshold is reached, preventing you from losing more than you’re comfortable with.

This makes trading accessible for those who are cautious or want to learn gradually. By starting small and using risk management features, you can test the waters without the fear of losing significant amounts of money.

4. No Need for an Expensive Education

Another reason many people believe they need thousands to start trading is the assumption that a deep understanding of the markets requires costly courses, certifications, or access to insider knowledge. While education is important, there are now many free resources available that can help you get started.

Many trading platforms offer educational resources right within their dashboards, helping you learn as you go. Deriv is one such platform, providing free tools and guides to help beginners understand trading strategies and market trends, all without spending money on high-priced courses.

Curious about learning to trade on a budget? Check out Deriv’s free educational resources to kickstart your trading journey.

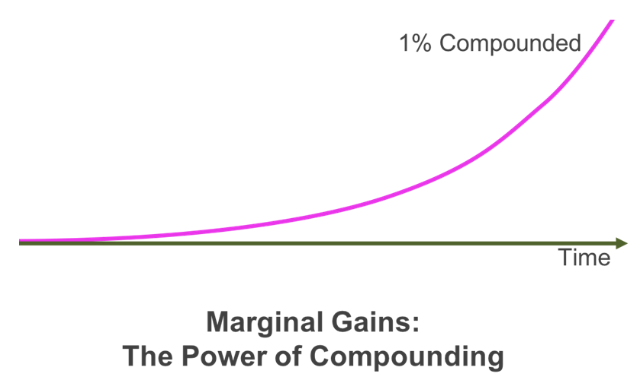

5. Compounding Gains: Start Small, Grow Big

Starting small doesn’t mean staying small. By making steady, smart trades with a small amount of capital, you can take advantage of compounding gains over time. Even modest returns can grow into significant amounts with patience and a good strategy. The key is to start early and keep learning.

Trading platforms today, like Deriv, allow users to scale up their trading efforts as they become more comfortable and skilled. The option to start with a small deposit and gradually increase your investments means that anyone can participate in global markets, regardless of their financial background.

Conclusion

The notion that trading is only for the wealthy is outdated. Thanks to advancements in technology and the rise of low-cost trading platforms like Deriv, getting started with as little as $5 is not only possible—it’s common. With tools like demo accounts and risk management features, you can ease into trading without the financial risk that once kept many people out of the markets.

If you’ve ever wanted to explore trading but were held back by the myth that it requires a big bank account, now’s the time to take the plunge. Small steps can lead to big growth—and with the right tools and strategies, you’ll be well on your way to building your trading skills and portfolio.

Deriv offers complex derivatives, such as options and contracts for difference (“CFDs”). These products may not be suitable for all clients, and trading them puts you at risk. Please make sure that you understand the following risks before trading Deriv products: a) you may lose some or all of the money you invest in the trade, b) if your trade involves currency conversion, exchange rates will affect your profit and loss. You should never trade with borrowed money or with money that you cannot afford to lose